So this was the first question on the quiz:

So for part A, it's simple. Just use the TVM solver. But the sneaky part is with the down payment. Be sure to subtract $4000 from the total price of the new car. The value that you get will be your [Present Value], then [Alpha][Solve] to get the monthly payment.

For part B, it's just as simple. the monthly payment for rent is $325, and she rents for 3 years. (you multiply 325x36=11700). Then you have to read carefully because it says that she wants to purchase the car afterwards, and that will cost $8000. So you just add the $8000 to $11700.

For part C, they are asking which is the better deal. To figure that out take the monthly payments of buying, and multiply that by 36, then you must remember to add the $4000 down payment. That will give you the TOTAL AMOUNT PAID FOR BUYING THE HOUSE. Since there are no down payments to renting the answer you got in part B is the TOTAL AMOUNT PAID FOR RENTING. Then you compare the total costs, and the smaller value is always the best one! And subtract them from each other to find how much she saved.

And the second question...

We wanted to find out how much her tractor will be worth after 6 years. There are a few ways that you can approach this question.

One way, which is the hard way, is to multiply $60000 by 8% and subtract that answer from $60000, then take that result and multiply it by 8%, then subtract again.

The second way that you can do this question is just multiply $60000 by 92% (because the tractor depreciates by 8% which means that you're KEEPING 92%), and just multiply that for every year, until six years.

The third way, you can do this question is by taking $60000 and multiply it by 92%, but then remember to raise it to the power of 6, since you want to know how much it is worth after 6 years.

And the next question...

This question was pretty straight forward. It gives you the monthly payment ($500), the interest rate (4%), how many times it's compounded (12), and it tells you when he makes payments (at the beginning of every three months, which is 4 times a year).

Just put it into your TVM solver, but the tricky part is when they say " at the BEGINNING of every 3 months". Look at where it says "PMT: END BEGIN" on the TVM solver. You have to put it on BEGIN in order to get the right answer!

AFTER THE QUIZ.. we went back to the question we worked on the previous day.

THIS WAS ALL OF OUR INFORMATION FROM THE QUESTION.

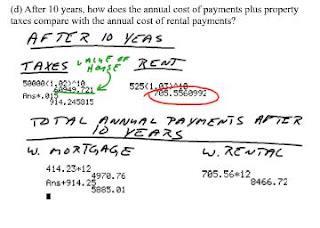

Then we worked on part D

So after 10 years, the value of the house is worth $60949.72. You multiply the value of the home by the percent that it appreciates, so that's 50000(1.02), then raise it to the power of ten because you want to know how much its worth after 10 years. To get the taxes multiply it by 0.015 because the question said that the taxes are 1.5% of the market value.

For renting, its just the monthly payments multiplied by how much it appreciates each month. In this case, the monthly payments are 525, and it is appreciating by 3%.

And to get the TOTAL ANNUAL PAYMENT after 10 years, if you are buying the house, you take the monthly payments, which we found in part a, and you multiply it by 12 (one year) then ADD the taxes. and you get $5885.01

And if you are renting, just multiply how much renting costs after 10 years which we got earlier, and multiply it by 12. and you get $8466.72

PART E asked:

They might want to rent instead of buy, even though it is more expensive because of the following reasons:

- when buying, the heating, hydro, electricity, and other expenses were not yet included. So that would mean more money for more expenses. Where as in renting you already have the heating and hydro, etc included in those monthly payments. - the family would probably rent, depending on their financial situation as well. They probably don't have the money up front to pay for the down payment if they wanted to buy a house.

AFTER THAT QUESTION, we moved on to another long question

But it wasn't all that bad. Here are the answers and explanations:

AND THAT IS ALL!!! Tomorrow is our "test". Two questions that are worth 1000 MARKS! Goodluck guys. See you tomorrow!

And the next scribe will be.... NAYDIA!!!!

No comments:

Post a Comment